The 2 decade old Indian wealth management industry seems to be coming of age. In line with global trends, wealth management and private banking is fast emerging as an attractive business model for many financial institutions in India.

India was the fastest growing wealth market globally in CY17. As per Boston Consulting Group, personal financial wealth in India grew 15 percent to $3 trillion in 2017 and is expected to grow to $5 trillion by 2022. Within this, the upper and ultra-high net worth individuals (UHNWI) segment, i.e. individuals with investable assets of $20 million or more, witnessed the fastest wealth growth.

We see the wealth management market on a sustained growth path given India’s long-term economic growth prospects which will lead to a rise in income levels. The low penetration will only improve as more individuals seek wealth advice.

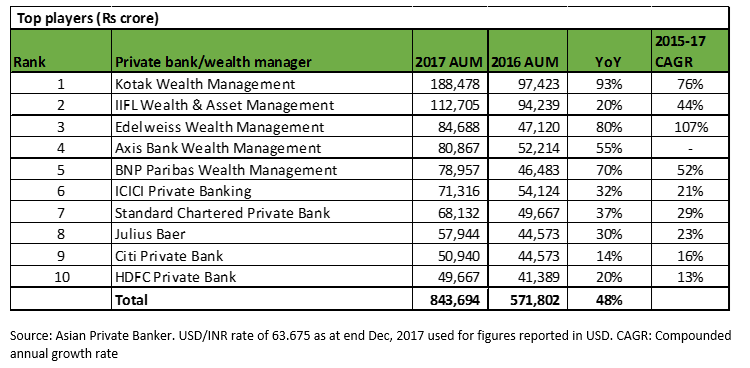

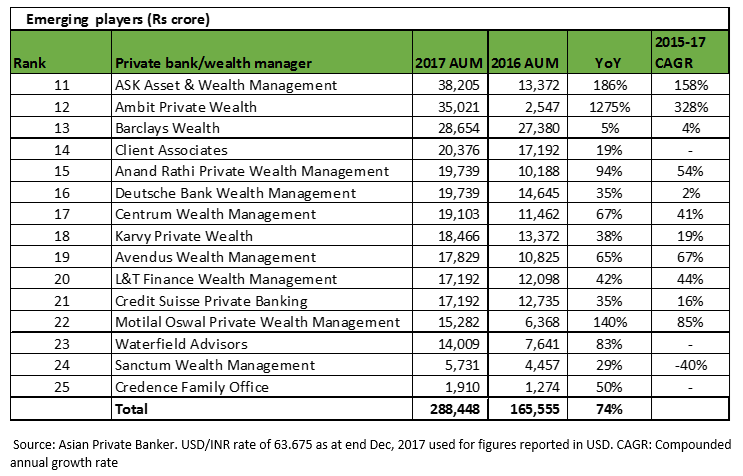

Homegrown players have clearly emerged as leaders in the wealth space. Of the Rs 10,78,018 crore managed by top 20 players, 72 percent of the assets under management (AUM) is with domestic players. Some global heavyweights – UBS, Morgan Stanley, HSBC and RBS – have already exited this space. The remaining are struggling to maintain and grow their market share. For instance, despite a 35 percent year-on-year increase in AUM, Credit Suisse, one of the largest private banks globally, slipped from the top 20 ranking in CY17. The void created by the exit of foreign banks in the wealth space is being smartly captured by domestic players like Kotak Mahindra Bank, IIFL and Edelweiss Financial Services.

What we like about the wealth business?

– Wealth services are relatively ‘low risk’ when compared to other activities like investment banking and extending credit to businesses and consumers. Revenue streams from wealth management are less cyclical compared to capital market-related businesses such as broking.

– Wealth business requires limited capital for growth, so it can potentially generate non-linear profit growth and return on equity (RoE).

– It does provide cross-selling opportunities. For instance, a large section of UHNWI clients globally use credit to enhance their returns. Hence, there can be an opportunity to grow the balance sheet with a thrust on lending and credit solutions to UHNWI.

What will drive the future profitability of wealth managers?

At present, many non-banking finance companies (NBFCs) are expanding their wealth unit. While the growing wealth pie can accommodate new entrants, rising competition can also increase pricing pressure. We don’t see competition impacting profitability of large well entrenched wealth managers for a couple of reasons. First, most players have increased headcounts of relationship managers (RM) in the last 1 year or so. The increase in vintage of newly added RMs can drive future growth and operating leverage. Second, the Indian wealth industry is still in a nascent stage in terms of product offerings. As it transits away from plain vanilla products to high margin products like lending and credit solutions, revenue yields can improve.

The current yield of around 80-100 basis points reported by large players like IIFL and Edelweiss is in line with global wealth managers.

Regulations and technology can be disruptive

Globally, wealth management is undergoing unprecedented transformation, mainly emanating from stricter regulations (such as European legislation like MiFID II) and technology developments. The Indian wealth industry can be expected to follow suit. In India, these risks seems non-imminent at present.

Having said that, wealth managers need to adapt to a market environment that is evolving. For instance, the Securities and Exchange Board of India’s (SEBI) proposed investment advisor regulations, if implemented, can change business models and cost structures for many existing players. The market regulator has proposed a clear demarcation between an investment advisor and distributor, wherein the latter is someone who sells commission-laden mutual funds.

Contrary to popular argument, clients are willing to pay wealth managers for better experience. From a client’s perspective, experience constitutes performance, engagement and trust. Growth of online wealth platforms, increasing popularity of MF investing through direct schemes and falling alpha in largecap fund management are some of the changes that will reshape the wealth management industry.

Our preferred picks

The wealth management industry in a sweet spot with multiple growth levers. The gradual but steady shift of household savings away from physical to financial assets is a big positive for the industry. The trend, referred to as ‘financialisation of savings’ received a fillip after demonetisation. This bodes well for wealth managers.

IIFL Holdings’ recent capital raising of Rs 746 crore further enhances the NBFC’s ability to expand the wealth franchise and can result in higher profitability going forward. Read: IIFL Wealth’s recent fund raising exercise only brightens its future prospects

Edelweiss Financial Services is rapidly gaining scale in the wealth management space and is now the third largest player in the segment. With wealth and asset management contributing only 14 percent to FY18 profits, its structure is more ‘bank-like’, with diversified revenue streams. Read: Edelweiss Fin Services & IIFL Holdings: Well positioned to tap high growth segments

Kotak Mahindra Bank: On the wealth management side, KMB has built a formidable business and caters to 40 percent of India’s top 100 families. Read: Kotak Mahindra Bank: Stock yet to fully value subsidiaries

Motilal Oswal Financial Services: Though the current size of MOFS’ wealth business is modest with assets of around Rs 15,000 crore, we see significant scope for an increase in retail AUMs, with cross-selling opportunity to broking clients. The company has ramped up its retail distribution business taking its AUM to Rs 7,500 crore in FY18. Read: Motilal Oswal: Investors with an appetite for some volatility can accumulate for the long term

While we like all players mentioned above, IIFL’s wealth franchise excites us the most in particular. We like Edelweiss as it has carved out a niche in certain segments like distressed assets. Its wealth business is like an icing on the cake.

In the case of KMB, banking operations still contribute 68 percent of FY18 profit. Going forward, as the wealth business continues to assume higher share of consolidated profitability, investors can expect valuation upside in the stock emanating from the wealth franchise. We expect growth in fee-based businesses such as asset and wealth management to support MOFS’ FY19 earnings, especially since its housing finance subsidiary’s performance is expected to remain weak.

Investors with a long-term horizon, wanting to participate in India’s growing wealth industry, should find these diversified financial institutions worthy contenders.

Market leaders

As per Asian Private Banker, the assets under management (AUM) of top 10 players increased by a whopping 48 percent in CY17.

source:-moneycontrol.