Elearnmarkets.com

Elearnmarkets.com

(Part of Kredent Group)

Fundamental analysis is a stock valuation methodology that uses financial and economic analysis to envisage the movement of stock prices.

The fundamental data used to analyse includes a company’s financial reports and non-financial information such as:

– Estimates of its growth.

– Demand for products sold by the company.

– Industry comparisons.

– Economy-wide changes.

– Changes in government policies etc.

The outcome is its ‘intrinsic value’ (often called ‘price target’ in fundamental analysts’ parlance). To a fundamental investor, the market price of a stock tends to revert towards its intrinsic value.

– If the intrinsic value of a stock is above the current market price, the investor would purchase the stock.

– If the intrinsic value of a stock is below the market price, the investor would sell the stock.

The factors that needs to be looked at for analysis

– The economic environment in which the company is operating.

– The political environment of the countries/markets in which the company is operating or based.

– Core competency and its advantage over competing companies.

– Does the company have a strong market presence and market share?

– Or, does it constantly have to employ a large part of its profits and resources in marketing and finding new customers and fighting for market share?

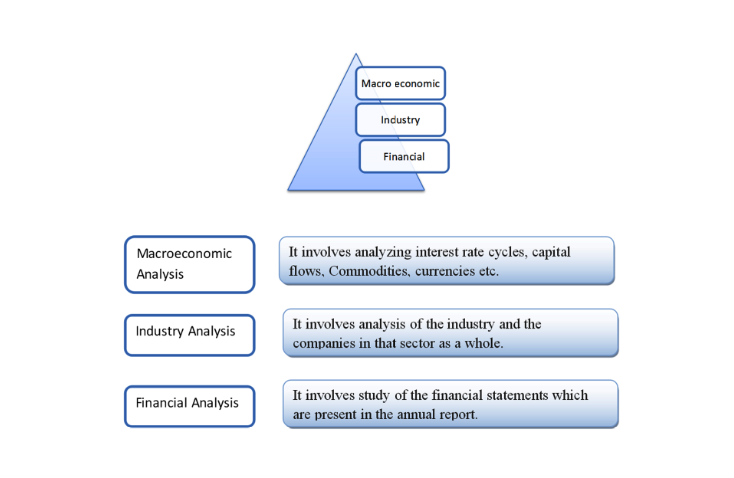

Steps of Fundamental Analysis:

For example, let us do a Top-down Analysis of an FMCG Sector

Macro Economic Analysis:

The Indian economy, being a developing mixed economy, is also the world’s seventh largest economy by nominal GDP and the third largest by Purchasing Price Parity (PPP).

The Indian economy was pretty sluggish. The slower growth was mainly on account of lower consumer demand and spending, along with slower growth in the agricultural and manufacturing sectors.

Consumer spending accounts for almost 60 percent of the economy. This was low due to a poor credit off take due to the liquidity crunch.

The Liquidity crunch in NBFC sector, coupled with an all-time high unemployment rate, led to the scarcity of funds, mostly in the rural areas.

The Indian economy runs on 4 engines:

– Private Investment.

– Public Investment.

– Internal Consumption (goods and services consumed).

– External Consumption (the export of goods and services)

Despite GST and demonetization shocks, the domestic consumption economy was growing at a healthy pace. Consumer spending is one the single most important driving force of any economy. When it slows down, it can damage the entire economy as a whole.

Growth Driver for the macro economy:

– The upcoming government needs to take up the uphill task of bringing up the growth of the economy by combining a few monetary measures with structural reforms that would help revive growth over time.

– The government needs to usher in Agricultural reforms and incentivise low-cost farming techniques and provide permanent solutions.

– The government has allowed 100 percent Foreign Direct Investment (FDI) in food processing and single-brand retail and 51 percent in multi-brand retail.

– These would fast track employment and provide growth for FMCG brands in organised retail markets, thus increasing consumer spending and an increase in new product launches.

Industry Analysis:

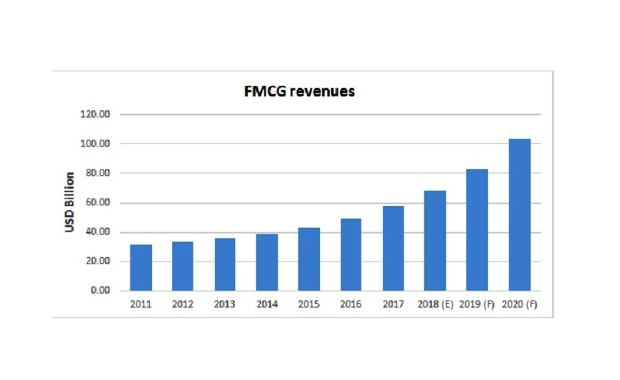

The FMCG sector is the fourth largest sector in the Indian economy with three segments – Food and beverages, healthcare and household amd Personal care. It has grown from $31.6 billion in 2011 to $52.75 billion in 2017-18.

In the revenue share, around 45 percent is from the rural segment and the remaining 55 percent is from the urban sector.

The three main segments of the FMCG sector are:

-Food and beverages. (19 percent of the sector)

– Healthcare. (31 percent of the sector)

– Household and personal care. (50 percent of the sector)

Growth driver for the industry are:

-Young demography, with young people contributing to 60 percent of our population with their changing preferences, the sector is expected to grow big.

-Lower per capita consumption and penetration level leaves room for more growth going ahead.

-Increased demand for the premium and branded products by rural India, which spends a major part of their earnings in the FMCG sector

-Thus, with proper government initiatives to focus on rural income, digitization, smaller product size, and rising awareness will drive the growth for the FMCG companies in India.

– An encouraging macro-economic environment, base effect, rural consumption, benefits of GST and the impacts of the election are some of the factors that will decide the growth factor of the industry in this year.

Financial Analysis:

Growth Drivers:

-The revenues are expected to rise due to an increase in mega food parks, which are expected to drive revenues.

-The shifting of the consumer’s focus from the unorganised sector to more branded products in the organised sector to create brand value.

-Growing youth population to drive the demand for better amenities and services.

-Online portals creating multiple and widespread reach to every nook and corner.

-Higher consumption to be aided with positive government policies.

Key Takeaways:

-Before any investment decision, a complete knowledge regarding the company’s sector, its industry and its pros and cons are a must.

-After doing in-depth top-down analysis, we understand the sectors potential and its growth drivers, thus then we can traverse on an investment decision.

– Following the path of right fundamental analysis will make us take the right decision with due clarity.

– Thus doing a little analysis always helps in taking a prudent decision.

(The article is sourced from Kredent InfoEdge)

Disclaimer: The views and investment tips expressed by investment expert on Moneycontrol.com are his own and not that of the website or its management. Moneycontrol.com advises users to check with certified experts before taking any investment decisions.

[“source=moneycontrol”]