Rents in London’s skyscrapers are soaring, rising much faster than those in other major cities around the world, due to booming demand for landmark buildings and a lack of new office space.

The upmarket estate agent Knight Frank said the cost of renting in office towers such as the Shard, Walkie Talkie and Cheesegrater rose 9.7% to $126 (£87.50) per square foot in the second half of 2015 from the previous six months and by 21.4% from a year earlier.

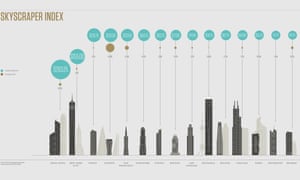

The 21-city skyscraper index compared the rental performance of commercial buildings of more than 30 storeys across the world against the first half of 2015. The UK capital also topped the table between January and June 2015, with an 11% rise in rents.

London rents rose twice as fast as those in San Francisco, at 4.76%, and three times quicker than in Hong Kong and Mumbai, where rents went up by 3%.

Will Beardmore-Gray, Knight Frank’s head of tenant representation and agency business, said rents in London were likely to head higher still due to “huge demand for space in landmark, tall buildings”.

He said London had not provided the tower space international companies were looking for until recently. “We’re starting to see more tower buildings in central London that you could put in any capital and be proud of.”

James Roberts, the chief economist at Knight Frank, said: “London has held up relatively well through what was a slow patch for the global economy over the last year.” He added that supply in the City office market was at its lowest since mid-2001.

London was likely to be top of the rental growth table again this year, he said, barring a vote to leave the EU in the June referendum, which could lead to the market stalling.

Roberts explained that firms that have been reluctant to relocate because of economic uncertainty would have to move to more modern premises at some point and that the “iconic architecture” of the new skyscrapers was a draw. “The buildings haven’t been boring boxes,” he said.

Tenants in the Walkie Talkie and Cheesegrater, both relatively recent additions to the London skyline, paid the highest rents in the capital last year. They are in the EC3 post code, dominated by the insurance industry, which has fared much better than the banking sector in recent years.

The towers are set to be overshadowed by 22 Bishopsgate – the reworked Pinnacle – which will be the largest office building built in London, after the City of London corporation backed its developers in a battle over the “right to light” with neighbouring buildings. The next skyscraper in the City, expected to be finished in late 2018, will be Brookfield’s 100 Bishopsgate.

There are 436 buildings above 20 storeys in the pipeline across London. The high-rise boom has provoked controversy over its impact on the skyline, while residents and businesses are concerned about wind tunnels and a lack of light.

Until about 10 years ago, there were few skyscrapers in London. Between theNatWest tower in 1979 and the Gherkin in 2003, not a single one was built in the City.

Bruce Dear, the head of London real estate at Eversheds, said: “There is a floating city above London in the Canary Wharf and City tower clusters. Space in these towers is scarce and high status, like high-rise white truffles. So the towers rental market obeys different laws to the rents of ground dwellers. Ultimately, scarcity is allowing these towers to defy the slowing global economy.”

The skyscraper index shows that Hong Kong remains the most expensive place to rent in the world – the average rent is more than twice as high as in London, at $263.25 per sq ft per year. New York remains in second place at $155, followed by Tokyo at $128.75 and London at $126.

Singapore was the only city where rents saw a significant decline in the second half of 2015. The 4.75% drop was caused by oversupply of office space and a drop in business confidence as a result of the slowdown in the Chinese economy. In Beijing, skyscraper rents dropped by 0.71% to $62.75 per sq ft.

Frankfurt posted a decline of 1.16%, to $51.75 per sq ft. Paris was flat at $55.75, while skyscraper rents in Toronto, Dubai and Madrid were also unchanged.

In the US, the booming technology sector has underpinned rental growth for towers in cities like San Francisco and Boston. Rent growth in Mumbai’s skyscrapers has also been driven by the tech industry, which overtook financial and business services as the top occupier of office space in the second half of 2015.

[Source:- Theguardian]