Lack of private investment has been the Achilles heel of the Indian economy for the last few years. While consumption and government spending have held up growth, private investment has remained sluggish for a number of reasons including excess capacity and the twin balance sheet problem.

There is now early optimism that the investment cycle is turning. Investment activity is recovering well, said the monetary policy committee in its June review. It added that investment activity will get a further boost as resolutions under the Insolvency and Bankruptcy Code pick up steam.

Is the optimism justified? Economists remain skeptical and say that, for now, much of the pick-up in investment is driven by the public sector rather than private enterprise.

Investment Growth Led By Public Sector?

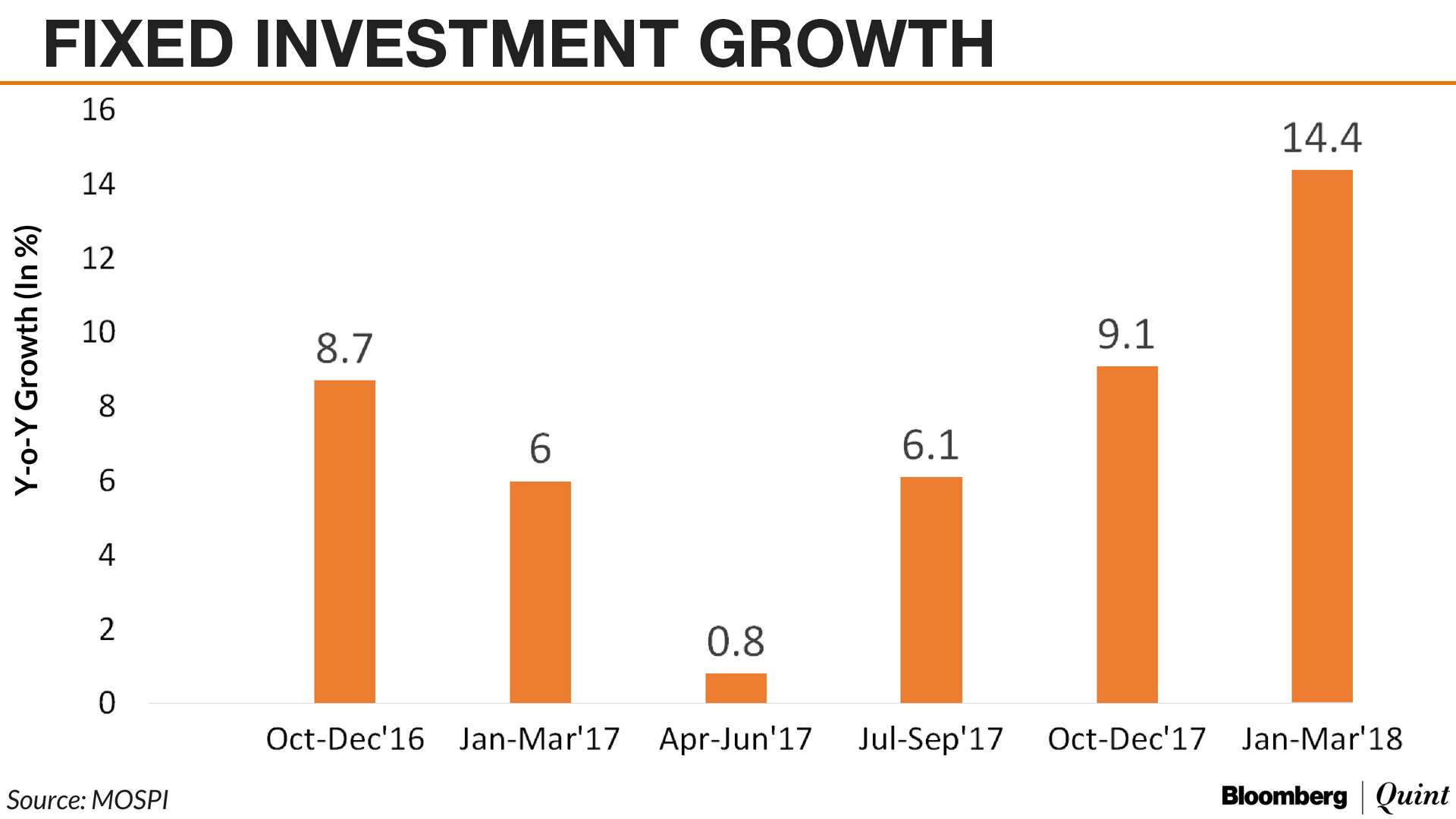

One key reason for the belief that investment is picking up is the increased pace at which gross fixed capital formation is rising. Seen as a broad indicator of investment in the economy, this component of GDP has seen accelerating growth for the last three quarters. The contribution of investment to GDP has also increased over the past few quarters. At current prices, it now stands at 29.1 percent.

Economists, however, are not convinced that this pick-up is driven by the private sector. “Most of the support for fixed investment appears to be coming from the public sector, though, with no convincing evidence as yet that the private sector is participating in any size,” said Sajjid Chinoy, chief India economist at JPMorgan in a note dated June 1.

Capacity Utilisation Still Below Peak

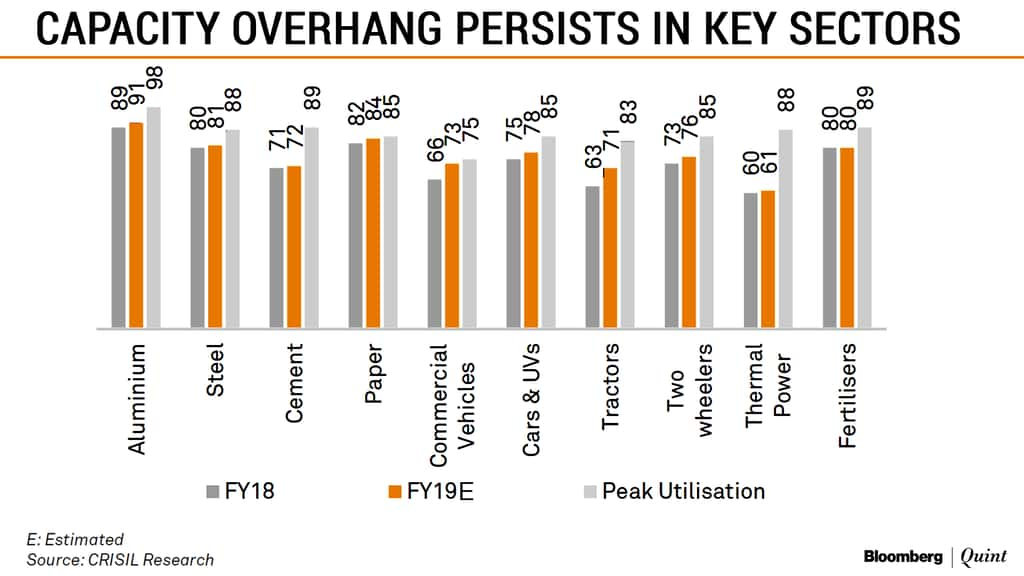

The MPC, in its resolution, also said that capacity utilisation by manufacturing firms increased significantly in the fourth quarter of 2017-18. The detailed findings of the capacity utilisation survey for Q4 have not yet been released.

However, according to Crisil data, capacity utilisation remains below peak levels. At the end of December, capacity utilisation stood at 74 percent, compared to 81 percent in March 2011 – the last time we saw increased private investment activity.

While capacity utilisation has improved, it is still not at the level that would lead to broad-based investment activity, said DK Joshi, chief economist at rating agency Crisil. Joshi, however, added that in some sectors, such as auto, utilisation levels are improving.

Behind The Surge In Capital Goods Output

Capital goods output saw a growth of 13 percent in April 2018. Capital goods output, as reported in the index of industrial production, has grown in double digits since December 2017, with the exception of a dip reported in the month of March.

As a result of the volatility in trend and considering the constituents of the index, Rupa Rege-Nitsure from L&T Finance Holdings remains skeptical of capital goods indicating a private investment revival.

In India, the capital goods category includes commercial and utility vehicles and is not restricted to just machinery,” Rege-Nitsure pointed out. She, however, acknowledged that the steady growth in consumer demand would help in better utilisation of capacity and, eventually, investments.

Capital Goods Imports Volatile

Capital goods imports, another indicator of investment activity, rose 33 percent in April. Imports of capital goods, led by machinery and transport equipment, saw the highest growth since September 2017, shows data available on the commerce ministry’s website.

However, longer-term data shows considerable volatility in imports, which have also been impacted by domestic disruptions such as demonetisation and the Goods and Services Tax.

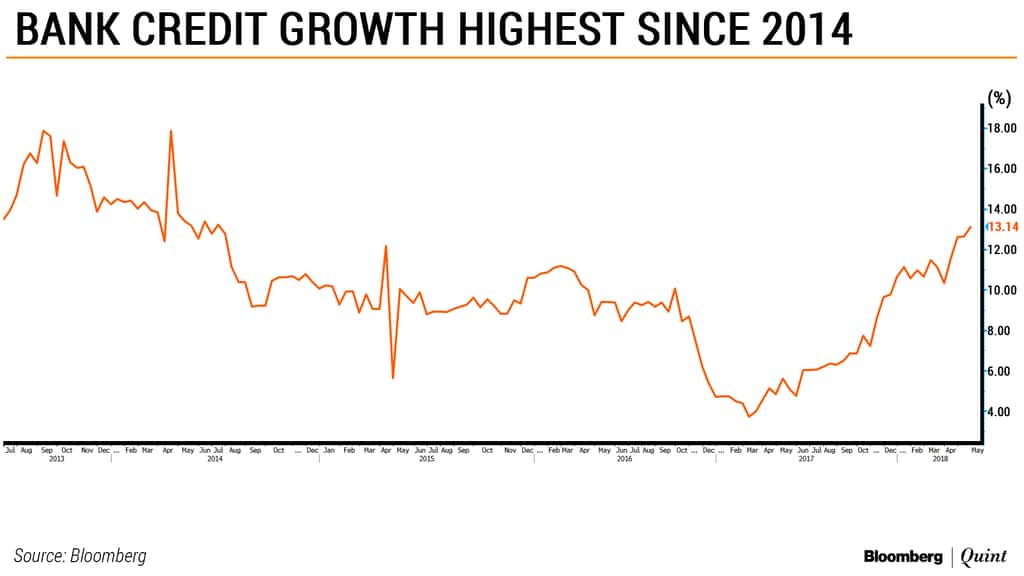

Credit Growth Led By Working Capital

A pick-up in credit growth is also being seen as a positive indicator for the economy. The latest fortnight for which data is available shows that scheduled bank credit rose by over 13 percent.

However, apart from a base effect, higher cost of commodities may be leading to the increased demand for working capital. Also the sectoral data on deployment of credit shows that credit to industry rose by just 1 percent in April 2018, in line with the trend since the start of 2018.

According to Sameer Narang, chief economist at Bank of Baroda, things are looking up but a broad-based revival in capex is still awaited. “Overall credit growth, which typically helps gauge investments, has seen an uptick driven by working capital requirements and consistent growth in retail,” said Narang.

But There Is Hope….

While current data does not show a return to animal spirits for private enterprise, the signs are positive. Economists believe that if domestic and external demand remains strong, excess capacity will slowly get used up.

Also there has been some deleveraging of balance sheets.

According to a report released by Crisil in May, companies rated by the agency have shown steady improvement in capital structure and debt metrics over the past four years. The median gearing (debt/equity) ratio of companies improved to 1.0 times in fiscal 2018 from 1.37 times in fiscal 2015. The median interest cover improved to 2.83 times in 2018 from 2.29 times in 2015.

Private banks are also sitting on a considerable amount of capital and would be willing to deploy it if new and bankable projects come up. Public sector banks, however, are still capital-starved but are hoping to recover capital, should large stressed accounts get resolved.

source:-bloombergquint