The stage has been set now for the Reserve Bank of India to lower interest rates sharply though the market has already factored in a 25 basis point cut at the upcoming policy review in April. That’s because the government has delivered on two counts: First, finance minister Arun Jaitley decided to keep the fiscal deficit target at 3.5 per cent for fiscal 2016-17, ignoring suggestions from within the government to spend more and then topping it by slashing interest rates on small savings schemes which banks had complained was preventing them from lowering rates.

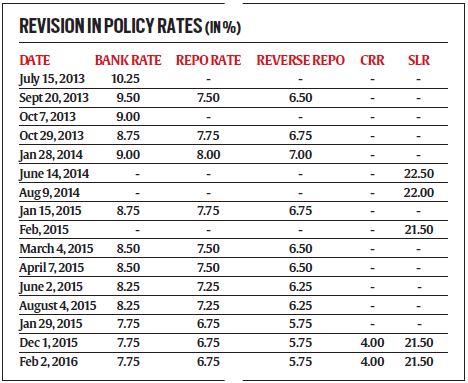

Analysts and economists now expect the RBI to take a cue and reduce the key policy rate, repo rate, from the current level of 6.75 per cent on April 5. The RBI had cut Repo rate by a cumulative 125 basis points in 2015 and inflation moderated sharply to 4.9 per cent in 2015 from 6.6 per cent in 2014, but banks reduced the lending rates by only 60-70 bps. That has been justified by banks and even the RBI has said that the high rates offered on small savings schemes compete with fixed deposits, making it tougher for banks to lower deposit rates, eventually delaying monetary policy transmission despite successive rate cuts.

Based on the recommendations of the Shyamala Gopinath Committee, the Centre revised the small savings rate on March 18 to ensure that the interest rates of small savings schemes are market linked. The government has decided that the interest rates for various small savings schemes for FY17 would be now reset every quarter based on the government securities yields of the previous three months.

There are two benefits: The cut in small savings rates, which along with marginal cost-based pricing of loans from April 2016, should facilitate an improvement in monetary policy transmission from the second quarter of 2016 onwards. Banks frequently cite the high small savings rate as cannibalising their bank deposits. Secondly, lower small savings rates will increase government (central and state) reliance on market borrowings to finance its fiscal deficit. The central government financing through small savings schemes will fall to Rs 15,000 crore in FY17 from an estimated Rs 40,000 crore in FY16. “Returns on post office deposits were lowered in the range of 0.5-1.2 per cent depending on the tenor, while on other schemes by 0.4-0.8 per cent. Changes will kick-in April onwards and be reviewed every quarter to keep it market-linked. With these schemes expected to pose less of a competition in the quarters ahead, banks will have an additional impetus to lower retail deposit rates to better reflect the 125 bps cut in the policy rates last year. This in turn is expected to help bring lending rates down, though any significant changes are only likely after the banking sector’s quarterly earnings are out next month,” said Radhika Rao, economist, group research, DBS Bank. While savers, especially senior citizens, are set to feel the pinch as their interest income would come down, the government is expected to be a beneficiary. “Typically, the government finances around 2-6 per cent of its fiscal deficit through small savings collections. In FY16 collections from small savings have been better than budgeted owing to the high small savings rates. We estimate that financing from small savings schemes will rise to Rs 40,000 crore in FY16 vs the budgeted amount of Rs 22,400 crore. However, in FY17, we estimate that central government financing via the NSSF (National Small Savings Fund) should moderate to Rs 15,000 crore (as rates come down), resulting in a shift towards market borrowing,” said Nomura economists Sonal Varma and Neha Saraf. This should reduce the Centre’s interest burden as market interest rates (10-year G-secs) are lower than the 9.5 per cent interest that the government has to pay for borrowings from the NSSF to finance its fiscal deficit. Funds collected under the small savings schemes are also used to fund state fiscal deficits. In fact, a state’s share is 50 per cent or 100 per cent of the net collection within that state (depending on what it opts for). Thus, lower collections from small savings schemes would also imply higher state government borrowings from the market, they said. “It will give banks greater flexibility to lower deposit rates in sync with falling inflation, while lowering the interest burden for the government at the margin. While consumers will receive lower interest on their savings, greater monetary policy transmission into lower lending rates over time will benefit consumers and corporates, boosting growth,” Varma and Saraf said. However, Soumya Kanti Ghosh, chief economic advisor, State Bank of India, has argued against an across the board cut in small savings rates and for the removal of the lock-in period. “Instead of a wholesale cut in PPF rate, the ideal approach for PPF rate would be to immediately shift to an age-wise interest rate structure with rates linked to long-term bank deposit rates for age group till 45, and offering a higher than market rate for people over 45. This will serve the purpose of ensuring a lower lending rate structure, adequate returns for senior citizens, lower interest expenditure and that the scheme runs for at least 15 years — the current prescription,” Ghosh said. With the decks being cleared for the RBI to act, expectations of a Repo rate cut are high. “We grow more confident of our call of a 25 bps rate cut on April 5 after February CPI (consumer price index) inflation slipped to 5.2 per cent. It will be recalled that we had expected the RBI to cut on February 2. Core CPI inflation remained benign at 5.1 per cent. Second, February WPI (wholesale price index) inflation fell below-expected (-) 0.9 per cent unchanged from last month. Third, IIP (index of industrial production) contracted 1.5 per cent in January — the third month in a row. Finally, finance Minister Jaitley has cut the FY17 fiscal deficit target to 3.5 per cent of GDP from 3.9 per cent last year. This obviously puts the onus of recovery on the RBI,” says Indranil Sen Gupta of Bank of America Merrill Lynch. While consumers will receive lower interest on their savings, greater monetary policy transmission in lower lending rates over time will benefit consumers and corporates. The stage is now set for a rate cut by the RBI with many analysts expecting a 25-50 bps cut in Repo rate.

[Source:- Indianexpress]